are hoa fees tax deductible in florida

Additionally an HOA capital improvement assessment could increase the cost basis of your. HOA fees are typically not 100 percent deductible but you may still be able to claim some portion of them as a writeoff.

HOA fees are often used to pay.

. In a few instances homeowners association fees can be counted as a tax deduction. Keep your property tax bills and proof of payment. A homeowners association runs a community by imposing certain rules preserving its aesthetics and maintaining various aspects of the neighborhood.

In general homeowners association hoa fees arent deductible on your federal tax return. However this only applies if you are self-employed and. However there are special cases such as when the home is rented out or used only part-time.

Yes if you work from home then you can write off certain expenses related to your home office which includes HOA fees. In general HOA fees are considered a part of your monthly housing costs and are not tax deductible. As a general rule no fees are not tax-deductible.

The answers not as straightforward as you might think. If you have purchased a home or condo you are likely paying a monthly fee to cover repairs and maintenance on the outside of your home or in common areas. A Homeowners Association HOA is a governing body that sets specific rules and guidelines that you agree to abide by when you purchase property in a condominium gated community apartment or other type of planned development.

The IRS considers these fees an assessment by a private entity which means they are not tax deductible. However if you purchased the home as a rental property you can deduct HOA fees because. Yes HOA fees are deductible for home offices.

Though many costs of owning a timeshare are deductible on your income taxes including your mortgage interest and property taxes the IRS does not allow you to deduct HOA. As a general rule most HOA fees are not tax-deductible. The short answer is no HOA fees are not tax deductible.

Say Thanks by clicking the thumb icon in a post. Deduct as a common business expense for your rental. You may be wondering whether.

If you live in your property year-round then the HOA fees are not deductible. HOA fees on personal residence - not deductible. How you use the property determines whether the HOA fee is tax-deductible or not.

Get a FREE HOA Analysis 530 419. For example if you own a home that is a rental property then you can deduct the. While the interest paid on home loans is tax deductible the fees paid to these privately held organizations are not.

If you live year-round in the house that you pay HOA fees on then youre out of luck. It does this with the help of hoa dues fees that the association collects from members. Before claiming your HOA fees you will have to determine how much space your home office takes up in your house.

State and local tax deductions are capped at a. Are HOA Fees Tax Deductible. Once you figure out the percentage youll use that number to deduct your HOA fees.

In general homeowners association HOA fees arent deductible on your federal tax return. Filing your taxes can be financially stressful. As a homeowner it is part of your.

Yes you can deduct your property taxes off your tax return. There may be exceptions however if you rent the home or have a home office. However there are special cases as you now know.

No HOA fees are not tax deductible if the property is your primary residence. If youre claiming that 10 of your home is being used as your home office you can deduct 10 of your property taxes mortgage interest repairs and utilities. In many homeowners associations HOA fees are typically not 100 deductible but you may be able to claim or write off a portion of them.

Do Hoa Pay Taxes Everything To Know About Hoa Taxes Hoam

Can I Write Off Hoa Fees On My Taxes

Everything About Hoa Fees You Need To Know The Best Guide

Are Hoa Fees Tax Deductible Clark Simson Miller

Do Hoa Pay Taxes Everything To Know About Hoa Taxes Hoam

The Villages Fl Cost Of Living How Much Does It Cost To Live In The Villages In Florida Data Tips

Are Hoa Fees Tax Deductible Clark Simson Miller

Are Hoa Fees Tax Deductible Experian

Are Hoa Fees Tax Deductible Here S What You Need To Know

The Tax Advantages Of Investing In Florida Real Estate Destin Property Expert

Home Buying 101 Tax Benefits For Florida Homeowners

Are Homeowners Association Fees Tax Deductible

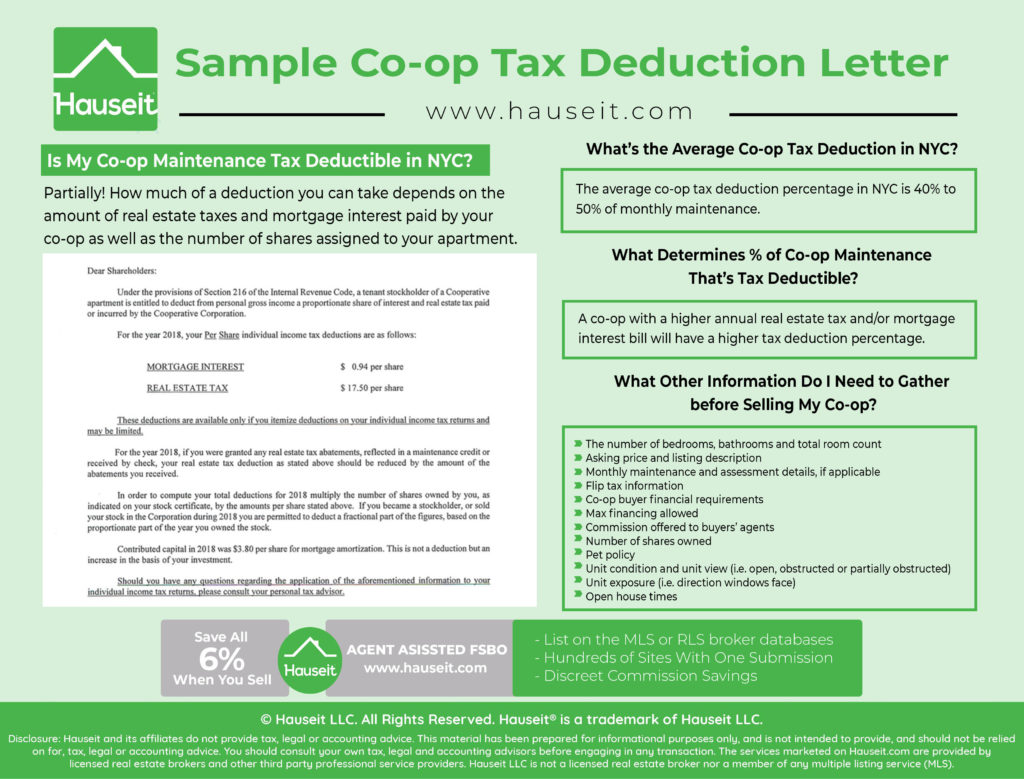

Sample Co Op Apartment Tax Deduction Letter For Nyc Hauseit

The Cost Of Buying And Owning A Property

Home Buying 101 Tax Benefits For Florida Homeowners

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

Are Hoa Fees Tax Deductible Clark Simson Miller