do i have to pay tax on a foreign gift

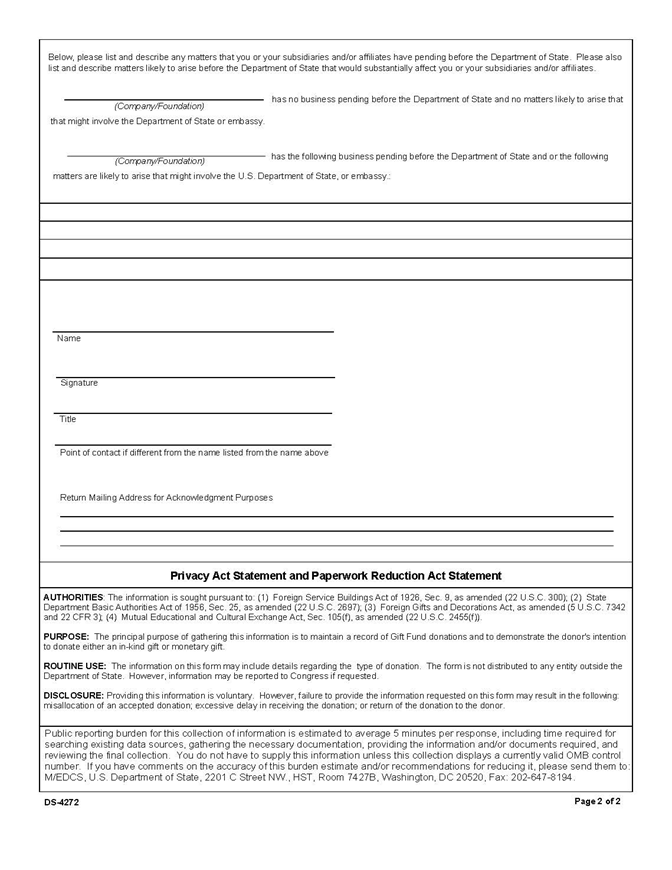

Otherwise you must file IRS Form 3520 the Annual Return to Report Transactions With Foreign Trusts and Receipt of Certain Foreign Gifts. You may also find additional information in Publication 559 or some of the other forms and publications offered on our Forms page.

Charitable Deduction Rules For Trusts Estates And Lifetime Transfers

The fact that the gift is from a foreign person is irrelevant.

. They are non-US persons and neither of them have ever. There are forms to repor. Under special arrangements the donee person receiving the gift may agree to pay the tax instead.

Gift tax and therefore dont need to report gifts for those purposes. Do I have to pay Taxes in the US. Person receives one or more gifts from a Foreign Person individual entity or trust the recipient may.

You gave any gifts of future interests Your gifts of. You will not have to pay tax on this though. Is there a Foreign Gift Tax.

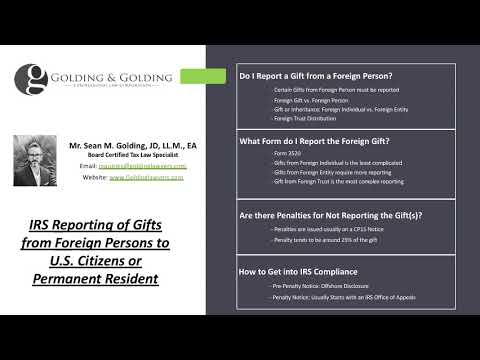

The burden of paying the gift tax falls on the gift-giver. For purported gifts from foreign corporations or foreign partnerships you are required to report the receipt of such purported gifts only if the aggregate amount received from all entities. If you happen to receive money from a foreign corporation or partnership as a gift and it is above 16649.

You can gift up to 11180 million in your lifetime without owing this tax but youll have to file a. If required you must report the gift on Form 3520. Further you must report foreign gifts from foreign corporations or foreign partnerships of more than 16649 as of tax year 2020 on Form 3520.

For example if Michelle receives a 700000 gift from her parents in Spain she does not need to pay a tax on the gift. Cash gifts from parents who qualify as foreign persons dont subject the recipient to taxes. No the gift is not taxable but it is reported on Form 3520.

If any foreign gift. The gift tax requires you to pay taxes on any large monetary gifts over a certain threshold. However if you are UK tax resident and you make a capital gain abroad from the sale of a property then this will need to be declared to.

In legal terms the gift isnt US. Generally the answer is No. 5 Ways to Connect Wireless Headphones to TV.

5 Ways to Connect Wireless Headphones to TV. I received a foreign gift. The person who does the gifting will be the one who files the gift tax return if necessary and pay any tax due.

However since the gift is from a foreign person you must report the gift received to. The same is true for those who receive an inheritance. Although you probably wont have to pay United States taxes on your foreign inheritance as an expatriate reporting it to the IRS is still necessary.

Surface Studio vs iMac Which Should You Pick. 2020-21This caller is receiving a gift from his family in Bangladesh. Do You Have To Pay Taxes On Money Transferred From.

Therefore if you receive. As the recipient of the gift you do Not report the gift on a US tax return regardless of the amount received. Person who receives a gift from a foreign.

The value of the gifts received from foreign corporations or foreign partnerships must exceed 16815 as of tax year 2021. The gift tax requires you to pay taxes on any large monetary gifts over a certain threshold. If the donor does not pay the tax the IRS may collect it from you.

The recipient will not have a requirement to include the gift in their gross income. Included in this area are the instructions to Forms 706 and 709. Again it is simply a declaration.

Surface Studio vs iMac Which Should You Pick. No gift tax applies to gifts from foreign nationals if those gifts are not situated in the US. In order to keep tabs on American money.

Foreign citizens generally dont have liability for US. According to the IRS if you are a nonresident alien who made a gift subject to the foreign gift tax you must file a gift tax return Form 709 if. However separate IRS regulations require recipients to.

There will be no income tax due on the gifting of money. This value is adjusted annually for inflation. Typically if a foreigner gifts money or property except intangibles such as securities to.

Tax with no Income Davids parents are citizens of China. Frequently Asked Questions on Gift Taxes Below are some of the more common questions and answers about Gift Tax issues. Do I Have To Pay Tax On A Foreign GiftGifts from foreign persons gifts from foreign persons.

5 This value is adjusted annually for inflation.

Foreign Gift Tax Ultimate Insider Info You Need To Know For 2022

Exploring The Estate Tax Part 1 Journal Of Accountancy

Tag Archive For Gift Tax Ask Liza Everyday Estate Planning

:max_bytes(150000):strip_icc()/GettyImages-1257968696-e86b3bc74baa43188ada18c7f700905c.jpg)

The Rules On Reporting Foreign Gifts And Inheritances

Tax Tips And Traps Related To Foreign Gifts Gift From Foreign Person

Gifts From Foreign Person How U S Citizens Residents Report A Foreign Gift To Irs On Form 3520 Youtube

How To Report A Foreign Gift Or Inheritance Of More Than 100k Schwartz Schwartz Pc

Form 3520 Reporting Foreign Gifts Trusts And Inheritances H R Block

Do I Have To Pay Taxes On Foreign Inheritance To The Irs International Tax Attorney

International Taxation Trans Pacific Accounting Trans Pacific Accounting And Business Consulting Llc

Foreign Gift Reporting Requirements Henry Horne

Taking The 3520 Penalty Fight To The Irs By Attacking The Penalty On Technical Grounds Sf Tax Counsel

Publication 54 2021 Tax Guide For U S Citizens And Resident Aliens Abroad Internal Revenue Service

Form 3520 Annual Return To Report Transactions With Foreign Trusts And Receipt Of Certain Foreign Gifts

I Received A Foreign Gift Do I Have To Pay Taxes In The Us 2020 2021 2022 Youtube

What Cash App Users Need To Know About New Tax Form Proposals Verifythis Com

Irs Foreign Reporting Tax Example 2018 Accounts Assets Gifts